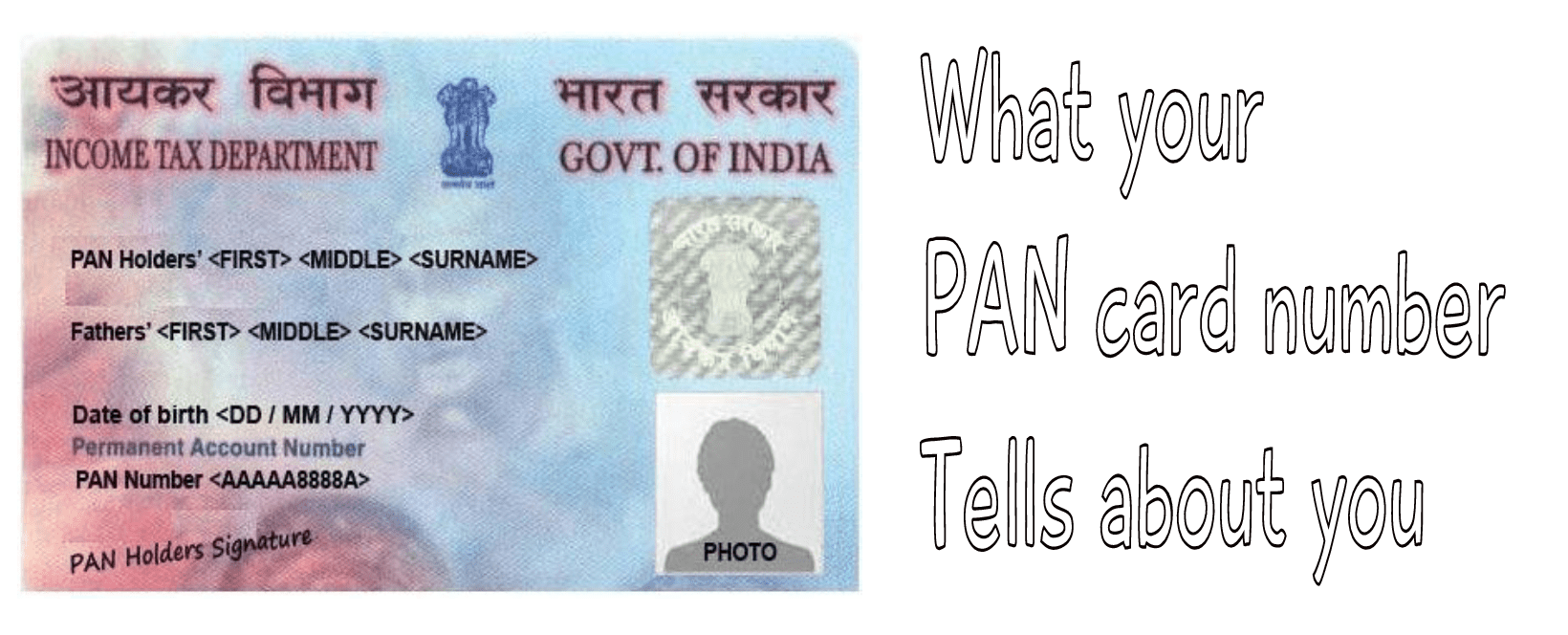

What your PAN card number tells about you

Whether it's getting your first salary, opening up a new bank account or filing your taxes - a PAN card is necessary for all your financial activities.

Back in 1972, when Permanent Account Number (PAN) was introduced, you could get multiple PANs from each centre you applied for - say one from Delhi and another from Bangalore.And due to multiple allotments, it was hard to maintain a centralised database.

This inadvertently defeated the purpose of a "unique" taxpayer identification number - so, in order to fix these flaws, a new series of PAN was introduced in 1995.

And it's the one we use today - "XXXPS 9999 A".

Now, to understand what this code means, we have to break it into 5 parts:

[1] "XXX": These first 3 characters represent an alphabetic series - it can contain any 3 letter series in English running from AAA to ZZZ.

[2] "P": The 4th character on your PAN represents your status as a PAN holder. For example,

- "P" for Person

- "C" for Company

- "H" for Hindu Undivided Family (HUF)

- "T" for Trusts

[3] "S": This represents the first letter of your last name (in the case of an individual.) For example, "S" could be for Sharma.

In case you're a non-individual PAN holder - the 5th character will represent the first letter of your name.

Let's take "Ditto Insurance" as an example. The 5th character in this case will be "D".

[4] "9999": The next 4 characters on your PAN are sequential numbers running from 0001 to 9999.

[5] "A": And the last character of your PAN number is always an alphabetic check digit - derived by applying a formula to the rest of the 9 characters.

So, ready to decode your own 10-digit PAN number?